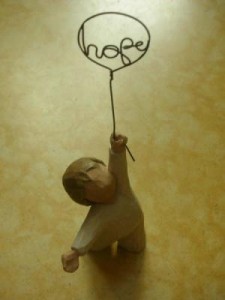

Hope for tomorrow…

These words are from a “tag line” I used to put under my real estate investing business name.

“Support for today, hope for tomorrow.”

Even though I don’t use that tag line any more, it is still the basis for all I do.

Now more than ever, I plan to continue to support others with all that I have to offer and in the process, providing hope.

I know this is last minute – but some extra seats just opened up.

I wanted to give you an opportunity to receive a free trip and free training when … Read the rest